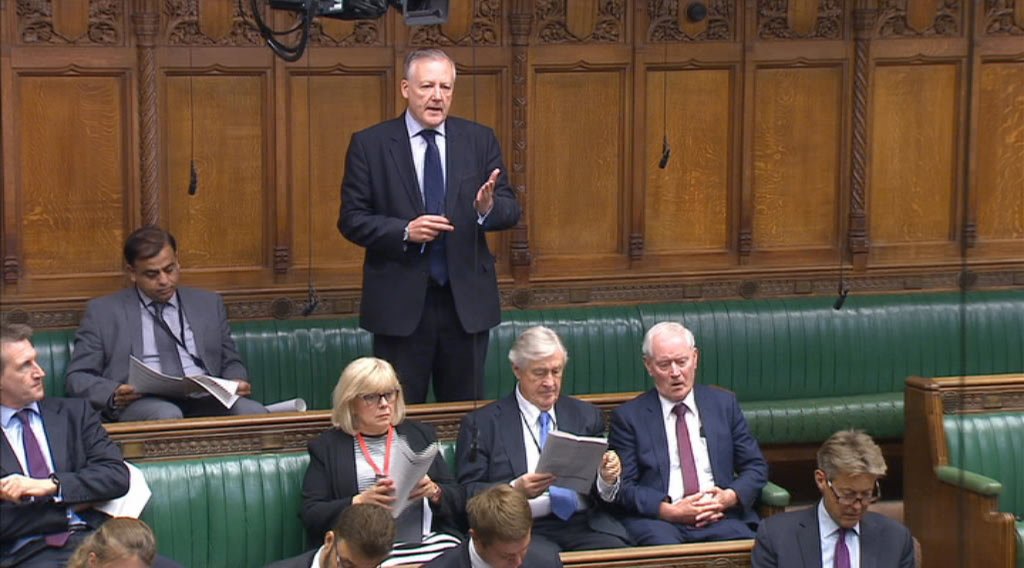

Kevan Jones, Member of Parliament for North Durham responds to a statement from Durham County Council advising about the support available to local businesses, following measures announced since the Budget.

Kevan said:

“I am pleased that Durham County Council have committed to writing to all businesses that are likely to be impacted by the changes, but I find it absolutely shocking that the Government has still not issued clear guidance on how these measures will be implemented. Businesses in County Durham need support now and the Government need to address this as a matter of urgency.”

Statement from Durham County Council on Business Rates and Help for Businesses Update:

Firstly, apologies for the length of this email however there is a lot of information in circulation relating to business rates and support for small businesses and I wanted to update you on the current position.

As you will be aware the Government has made a number of announcements on support to businesses with the most recent announcements yesterday. I am sure you will appreciate we are dealing with a changing situation which is making it extremely difficult to provide accurate advice to businesses. This is further complicated because we do not yet have guidance from government on the implementation of the various schemes. Without this we cannot implement any changes or new funding arrangements.

I thought it would be helpful however to update you on what we do know and how we are planning to deal with the guidance when it does come to us from central government. Below is a summary of the information that is being made available on the website for businesses to access.

In January, additional business rates measures were announced that will apply from 1 April 2020. The Budget on Wednesday 11 March 2020 confirmed and extended these measures. Yesterday, the Chancellor set out a further package of targeted measures to support businesses through this period of disruption caused by COVID-19. The packages of measures that we will be required to implement are as follows:

- increasing the retail discount from one-third to 50 per cent for eligible retail businesses occupying a property with a rateable value less than £51,000;

- extending the retail discount to eligible music venues and cinemas with a rateable value less than £51,000;

- introducing a pub discount of £1,000 to eligible pubs with a rateable value of less than £100,000 – this being in addition to the retail discount and will apply after the retail discount.

- Extending the £1,500 business rates discount for office space occupied by local newspapers for an additional 5 years until 31 March 2025.

In response to COVID-19, the government has gone further than previously announced to support businesses and stated the following:

- the retail discount will increase to 100% for 2020-21

- the relief will be expanded to the leisure and hospitality sectors

- the pub discounts will increase to £5,000

- a 12 month business rates holiday for all retail, hospitality and leisure businesses

Local Authorities will be compensated for these Business Rate measures via grants in 2020/21 although there is no information on when these grants will be paid.

Forecast Impact in County Durham

Retail discount

There are currently 855 properties in receipt of the 50% retail discount. The amount of discount is circa £3.4 million for 20/21. By doubling the discount as part of the COVID-19 measures, this will increase to an estimated £6.8 million in 2020/21. By extending the discount to the leisure and hospitality sectors it is estimated that a further 269 properties will be eligible for the relief, amounting to a further estimated £1 million of reductions.

By introducing a business rates holiday for all retail, hospitality and leisure businesses it is estimated that an additional 333 properties will be eligible for the relief amounting to circa £32 million. Included in this figure are national companies / superstores which may not qualify due to State Aid limits and further clarity is required from Government on this particular issue.

Pub discount

There are currently 186 properties in receipt of the pub discount. Most of these properties will now be eligible for the 100% retail discount which means that the pub discount will not be applicable. For the pubs with a rateable value of between £51,000 and £99,999 that do not qualify for retail discount, the pub discount will be increased from £1,000 to £5,000. Currently 32 properties will receive the increased amount, totalling £160,000. It is expected that the pub discount will no longer be relevant due to the increased measures around the retail discount.

In terms of the additional measures announced in the last week:

Small business grant funding

The government recognises that many small businesses pay little or no business rates because of Small Business Rate Relief (SBRR). To support those businesses, as part of the Budget, the government announced that it will provide £2.2 billion of funding for Local authorities in England.

This will provide £3,000 of support to around 700,000 business currently eligible for SBRR or Rural Rate Relief, to help meet their ongoing business costs. For a property with a rateable value of £12,000, this is one quarter of their rateable value, or comparable to 3 months of rent. Most properties that are eligible for SBRR will have a lower rateable value, and so this will represent an even greater proportion of their annual rent. On 17 March 2020 the Chancellor announced that this grant will be increased to £10,000.

The Chancellor also announced a £25,000 grant will be provided to retail, hospitality and leisure businesses operating from premises with a rateable value between £15,000 and £51,000

In County Durham there are 7,200 properties in receipt of Small Business Rate Relief and an estimated 1,124 properties that may be eligible for the £25,000 grant so the impact is likely to be significant both from a cost and administrative perspective.

Guidance on the business rates holiday is expected to be published by Government by 20 March 2020 with guidance on the grant scheme to be published shortly thereafter – possibly next week although I am pushing hard to have this made available as soon as possible. We understand that funding for the grant schemes will be provided to local authorities by government in early April.

What this means

All the measures / discounts announced will need to be implemented through our Discretionary Rates Relief Policy. Our practice has been to award the relief / discount to those properties that meet the criteria (based on the records held in the Business Rates system), highlight any State Aid issues and ask businesses to request that we disapply it if they contravene these limits. We will continue to do this as this reduces the burden on businesses.

We are awaiting the detailed guidance and in the meantime we are working up our operational delivery requirements and working with our software providers to ensure that we can action these once we receive the detailed guidance. This is the case for other local authorities across the region that I have spoken to today.

I am aware that members have and will continue to receive representations from local businesses. Following the announcements yesterday I have arranged to write to all businesses we believe will be affected by the changes setting out the current position and that they may wish to consider not making their initial business rates payments until we receive guidance and implement the new arrangements. Whilst this increases the risk to the council I am comfortable that in the wider context this is appropriate. We are also working on how we deal with queries when the guidance is issued. Hopefully the letter to businesses will help with this.

I trust that this email sets out the position as clearly as possible. We are doing everything we can to ensure we can action the proposals when guidance is received and I know the team are working extremely hard to be ready to take this forward, however as I have set out, we cannot begin to implement until we have government guidance.

I will keep you updated as things progress which will hopefully be very soon.

Regards

John

John Hewitt

Corporate Director of Resources